The search for the perfect accounting platform often feels like a balancing act: you need powerful tools, but you can’t afford a complex system that eats up time better spent serving customers. For decades, one name dominated the conversation, but in the modern, cloud-first era, Xero accounting software has emerged as the definitive choice for ambitious small businesses, freelancers, and global entrepreneurs.

If you’re a small business owner—whether you run a local HVAC service, manage a digital marketing agency, or sell goods online—your financial health depends on clean, real-time data. Xero promises to deliver this data in an interface so intuitive and beautifully designed that bookkeeping stops feeling like a chore and starts feeling like a strategic advantage.

This comprehensive, data-driven review dives deep into Xero’s features, pricing, and overall value proposition in 2025. We’ll show you exactly how Xero stacks up against its competitors and why it might be the last accounting solution your business will ever need.

Xero at a Glance: The Cloud Accounting Philosophy

Xero was built from the ground up to operate exclusively in the cloud, giving it a massive advantage in flexibility and design. It wasn’t burdened by legacy desktop code, allowing it to focus on three core principles:

- Beautiful Design: The dashboard is clean, intuitive, and easy to navigate, reducing the initial learning curve.

- Real-Time Collaboration: Xero connects business owners directly with their bookkeepers and accountants on a single, shared ledger.

- Extensibility: Xero is an open platform, integrating with thousands of specialized apps to create a tailored, end-to-end operational ecosystem.

Why Xero is Built for Growth

Unlike systems designed solely for transaction processing, Xero’s design prioritizes cash flow visibility and speed. For a small business, time is money, and Xero excels at turning hours of manual reconciliation into minutes of automated review. This is the foundation upon which its value is built: minimizing administrative overhead so you can focus on core revenue-generating activities.

Deep Dive: Essential Features That Drive Business Growth

To truly understand Xero’s value for the small business, we must look beyond the standard checklist of features and examine how its core functionality is executed. This is where Xero shines, offering a seamless and integrated experience across all critical financial areas.

1. The Financial Hub: Unbeatable Bank Feeds and Reconciliation

The most time-consuming task for any business owner is reconciling bank transactions. Xero transforms this process into a quick, even enjoyable, daily task.

Real-Time Data Feeds

Xero connects securely to thousands of banks and financial institutions globally. Once connected, your bank transactions flow automatically into Xero, usually overnight, providing a near-real-time view of your cash position. This immediacy is vital for spotting issues like fraudulent charges or bounced checks quickly.

Transaction Matching and Machine Learning

This is Xero’s superpower. The platform uses intelligent machine learning to match incoming bank transactions to invoices and bills created in Xero.

- Simple Matching: If you issue an invoice for $500 to “ABC Client” and a $500 deposit appears from “ABC Client,” Xero suggests the match instantly.

- Bank Rules: For recurring transactions (like rent, utilities, or advertising fees), you can set up Bank Rules. This tells Xero exactly how to code the expense every time it appears. For instance, any debit from “Facebook” is automatically coded as “Marketing Expense.” Once rules are set up, reconciliation becomes a rapid click-and-confirm process.

- Cash Coding: For businesses with high volumes of similar cash transactions (e.g., retail or hospitality), the Cash Coding feature allows rapid bulk processing of transactions, drastically cutting down reconciliation time compared to traditional methods.

The result is a workflow where a business owner or bookkeeper can process hundreds of transactions in minutes, maintaining clean books without manual data entry.

2. Cash Flow Mastery: Professional Invoicing & Quotes

Cash flow is the lifeblood of a small business. Xero provides powerful tools to ensure you get paid faster and maintain professional relationships with your clients.

Beautiful and Customizable Invoicing

Xero allows you to create invoices that reflect your brand identity. You can customize templates with your logo, colors, and specific terms and conditions. These aren’t just PDF attachments; they are interactive, allowing clients to view the invoice online.

Automated Reminders (Invoicing Automation)

Late payments are the biggest threat to small business solvency. Xero tackles this with powerful automation. You can set up automated email reminders to chase overdue invoices based on specific rules (e.g., send a polite reminder 3 days before the due date, a firm reminder 1 day after, and a serious one 7 days after). This automation removes the awkwardness and time commitment of manually chasing payments.

Integrated Payments for Faster Collection

Xero integrates directly with popular payment gateways like Stripe, PayPal, and GoCardless. By including a “Pay Now” button directly on the electronic invoice, clients can pay instantly via credit card or bank transfer. Studies show that invoices with integrated payment options are paid significantly faster—often within hours, not weeks.

Quotes and Estimates

Before an invoice, there’s a quote. Xero lets you create professional quotes that clients can accept online with a single click. Once accepted, the quote is instantly converted into a draft invoice, eliminating redundant data entry.

3. Integrated Ecosystem: Payroll, Inventory, and Projects

Xero’s power is multiplied by its commitment to an open API, meaning it integrates with over 1,000 apps—far more than many competitors. This allows you to build a custom tech stack that fits your industry perfectly.

Payroll Integration (Gusto and Others)

While Xero offers its own proprietary payroll feature in some countries, in the US, it integrates perfectly with specialized payroll providers like Gusto. This ensures a two-way sync: Gusto handles the complexities of tax filings and payments, while Xero automatically records the payroll expenses, keeping the general ledger accurate without double-entry. For a growing business, relying on a specialist like Gusto via Xero is often the most compliant and streamlined solution.

Inventory Management (Stock Tracking)

For retail, e-commerce, and trade businesses, managing stock is critical. Xero tracks inventory quantities and values, allowing you to monitor stock levels and costs of goods sold (COGS) in real-time. This feature ensures your financial statements are accurate and helps prevent stockouts. For more complex needs, Xero integrates seamlessly with specialized inventory apps like Dear Inventory or Cin7.

Project and Job Tracking (Time/Expense)

Service-based businesses (agencies, consultants, contractors) need to track time and materials against specific jobs. Xero’s native Projects feature allows employees to log time and expenses directly against a client job. These records can then be instantly invoiced, ensuring no billable hour or cost is missed. This integration of operations with accounting is a major workflow benefit.

Sales Tax and Compliance

Xero automatically handles complex sales tax calculations based on location and tax rates. By linking to platforms like Avalara, it simplifies sales tax filing across multiple states or jurisdictions, which is critical for e-commerce businesses operating nationally. The reports are audit-ready, providing peace of mind.

4. Collaboration and Mobility: Working Together, Anywhere

Xero facilitates true financial collaboration and provides tools that work as fast as you do.

The Advisor Role (Accountant/Bookkeeper Access)

One of Xero’s defining features is its seamless collaboration tools. You can invite your accountant or bookkeeper to access your Xero file at no extra cost. They see the exact same real-time data you do, allowing them to troubleshoot issues, run payroll, and prepare tax reports without needing to exchange files or wait for month-end data dumps. This simplifies the client-advisor relationship enormously.

The Xero Mobile App

The mobile app is robust, making Xero truly portable. You can:

- Capture Receipts: Snap a photo of a paper receipt and upload it instantly. Xero reads the data (date, vendor, amount) and automatically creates a draft expense transaction. This feature, known as “Hubdoc,” eliminates the need for a shoebox full of receipts at tax time.

- Send Invoices: Create and send professional invoices immediately after finishing a job, perfect for field service professionals.

- Monitor Cash Flow: Check bank balances and outstanding invoices from anywhere, providing critical financial awareness on the go.

The mobile-first design ensures that administrative tasks are handled in micro-moments throughout the day, preventing them from piling up.

Xero vs. The Competition: A Head-to-Head Analysis

When small businesses consider cloud accounting, the inevitable comparison is with QuickBooks Online (QBO). While QBO is often viewed as the traditional leader, Xero provides compelling advantages, especially for modern, growth-focused SMEs.

Xero vs. QuickBooks Online (QBO)

| Feature Differentiator | Xero Advantage | QBO Advantage |

|---|---|---|

| User Interface & Design | Superior: Clean, modern, highly intuitive design focuses on workflow and simplicity. | Functional but often cluttered and complex, with a steeper learning curve. |

| Bank Reconciliation | Superior: High-speed bank rules and excellent machine learning make reconciliation significantly faster and easier. | Reliable, but often requires more manual oversight and confirmation. |

| Accountant/Bookkeeper Collaboration | Superior: Collaboration is baked into the DNA; unlimited users for advisors at no extra cost. | Often charges for additional user seats, making advisor access costlier for the client. |

| Global Reach | Superior: Native multi-currency support in Standard and Premium plans; strong global presence outside of North America. | Multi-currency support is limited to higher-tier plans and focuses heavily on the US market. |

| Pricing | Flexible, clear tiers suitable for very small businesses and those focused on growth. | Often requires an upgrade to a higher tier to access necessary core features like inventory or time tracking. |

The Bottom Line: If your business values efficiency, beautiful design, collaboration with your financial advisor, and a seamless global operation, Xero is the winner. If you already have deep, complex workflows built around other Intuit products, QBO may offer simpler integration.

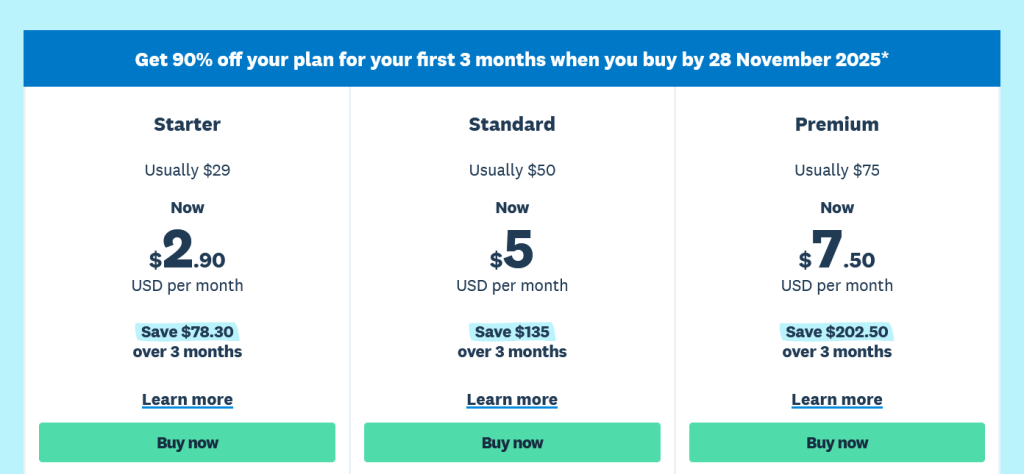

Pricing and Plans: Choosing the Right Xero Package

Xero offers three main pricing tiers, allowing businesses to scale their accounting solution precisely as they grow. This is a significant advantage, as you only pay for the features you truly need.

The Xero Plans Detailed (Approx. 200 words)

| Plan Name | Best For | Key Features & Limitations |

|---|---|---|

| Starter | Sole proprietors, freelancers, and small businesses with very few transactions. | Limited to 20 invoices/quotes and 5 bills per month. Ideal for basic expense tracking and initial professional invoicing. |

| Standard | Growing businesses with consistent transaction volume. (Most Popular) | Unlimited invoicing and billing. Includes reconciliation, Hubdoc document capture, and integrated payment gateways. Essential for steady growth. |

| Premium | Businesses with international clients or multi-currency needs. | Includes all Standard features plus multi-currency support (invoicing, paying bills, and bank reconciliation in different currencies). Essential for e-commerce and global service providers. |

Important Note: The Standard plan offers unlimited invoicing and is the sweet spot for the vast majority of small businesses who have passed the initial startup phase. The price point is highly competitive when considering the unlimited collaboration it offers.

Seamless Setup: Getting Started with Xero

Migrating to a new accounting system can seem daunting, but Xero has streamlined the process to minimize downtime and risk.

1. Preparation and Cleanup

Before migrating, we recommend cleaning up your existing data, closing outstanding invoices, and ensuring your chart of accounts is finalized. A smooth transition starts with clean records.

2. Migration Tools

If you are moving from a desktop product like QuickBooks Desktop, Xero has partnered with migration specialists who can handle the complex data transfer. If you are starting fresh or moving from a simple spreadsheet system, the setup is even easier. You simply import your contact lists and opening balances.

3. Bank Feeds and Chart of Accounts

The final step is connecting your bank feeds and reviewing Xero’s default Chart of Accounts to ensure it aligns with your business’s financial structure. This should always be done in collaboration with a Xero-certified bookkeeper or accountant, ensuring your setup is compliant from day one.

The entire process, when handled professionally, typically takes less than a week, and often just a few hours of the business owner’s time, proving that the move to a better platform doesn’t have to be disruptive.

Security, Support, and The Xero Ecosystem

Security

Xero maintains bank-grade security, including 256-bit SSL encryption and multiple layers of protection. Because the data is stored in the cloud, you never have to worry about local hardware failure, theft, or data loss. Regular backups are managed by Xero, providing far greater security than local systems.

Customer Support

Xero provides 24/7 online support through email and detailed online documentation. While it does not offer phone support, the online response times are generally fast. More importantly, the vast network of Xero-certified advisors means local, personalized support is always available for complex questions.

The App Marketplace

The true long-term value of Xero lies in its App Marketplace. Need advanced time tracking? Connect with TSheets. Need better CRM? Integrate Salesforce. Xero acts as the reliable financial backbone that connects to and empowers all your other operational tools, future-proofing your business tech stack.

The Verdict: Is Xero Right for Your Small Business?

Based on its market positioning in 2025, Xero is unequivocally the best cloud accounting solution for the modern, growth-focused small business and the entrepreneur who values design and efficiency.

If your business is struggling with slow reconciliation, late payments, or complicated software, Xero will solve those problems immediately. It saves time, fosters collaboration with your financial team, and provides the crystal-clear financial overview necessary to make smart decisions and accelerate growth.

If you are ready to stop managing paperwork and start managing your financial future, Xero is the powerful, intuitive platform built for exactly that purpose. Get started today and transform the way you do business.